Streamlines microfinance operations, offering secure, efficient, and scalable solutions tailored to empower financial growth

Microfinance Institutions flourish through community bonds. To excel, they require solid digital transformation for profitability and customer relevance

Onboarding, accounts, communication, tracking, support, compliance, integration.

Adding funds or accessing saved money whenever needed

Loan origination: initiate loans; credit management: monitor and maintain credit.

Account management involves reporting balances, transactions and customer data.

Efficiently oversee cash flows and process transactions in bulk batches

Streamling insights through data-driven reports and comprehensive dashboards.

our corebanking system is designed for productivity, offering distinctive features that enhance efficiency and streamline user experience.

KYC

(Know your Customer)

Begin by creating a client, then follow with KYC process before opening an account for secured customer verification and compliance .

Multi Factor

Authentication

Enhance security by requiring secondary verification through SMS codes sent to users' mobile devices for account access and protection

Customizable

Workflow

Tailor approval processes to specific activities, ensuring efficient and flexible authorization mechanisms within the system for streamlined operations

Multi Lingual

Interface

Seamlessly switch between languages in real- time to cater to diverse users' linguistic preferences within the interface for enhanced accessibility

Inbuilt Work

Management

Boost productivity with an integrated to-do list, enabling users to efficiently manage tasks within our extensive work management system.

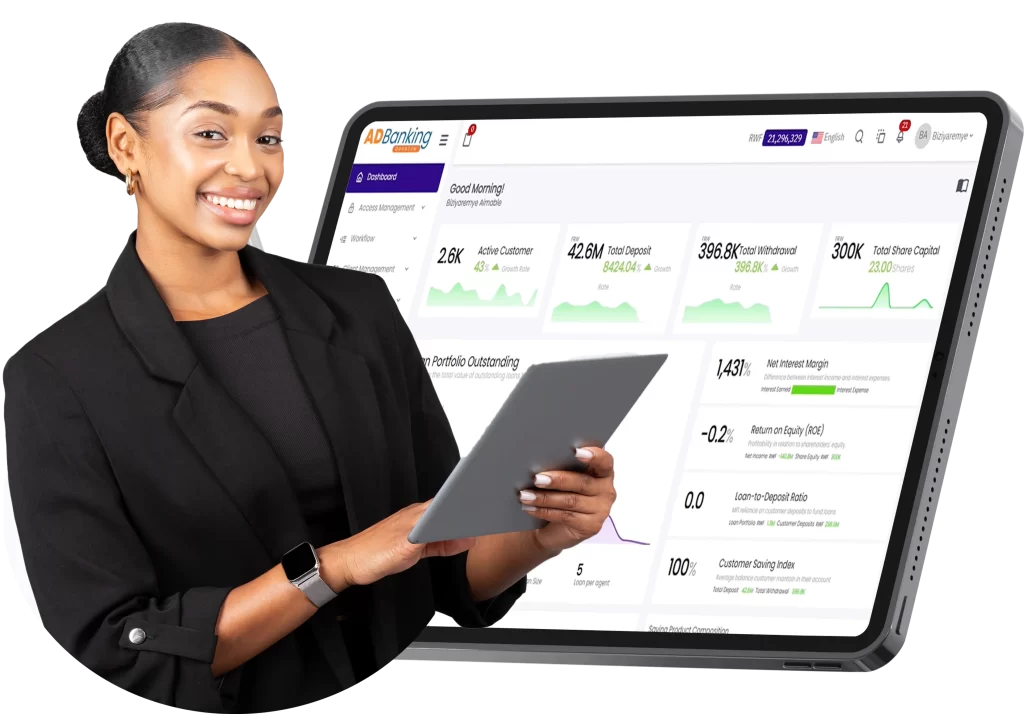

Interactive

Dashboard

Unleash the power of real-time data with our interactive dashboard, displaying dynamic business KPI metrics for informed decision-making.

Multi-factor authentication and robust compliance measures ensure data protection.

Automated workflows and integrated processes boost efficiency.

User-friendly interface and multilingual support enhance usability.

Read success story of ubaka microfinance

Read how quantum has integrated mobile banking at Lanala Finance

Read how quantum is in microfinance wishlist

A Core banking system with a comprehensive range of functionalities to meet all your microfinance needs

Let’s work together to reach your goals.

Reach out to us, and we’ll be happy to help

UMOJA Building, 1st Floor

KN 3 Street, Kigali-Rwanda

We are here to help you and your business. Contact us using the button below.